Exploring Antenuptial Contracts: A Smart Selection for Financial Preparation Prior To Marital Relationship

Antenuptial contracts are gaining focus amongst pairs getting ready for marriage. These arrangements offer as a proactive strategy to financial preparation, clearing up possession division and securing specific rate of interests. Numerous individuals continue to be uninformed of the possible advantages and misconceptions bordering these agreements. Comprehending their importance can cause even more transparent partnerships. As pairs explore this vital subject, they might find themselves pondering the most effective method to launch such discussions. What should they think about first?

Understanding Antenuptial Agreements

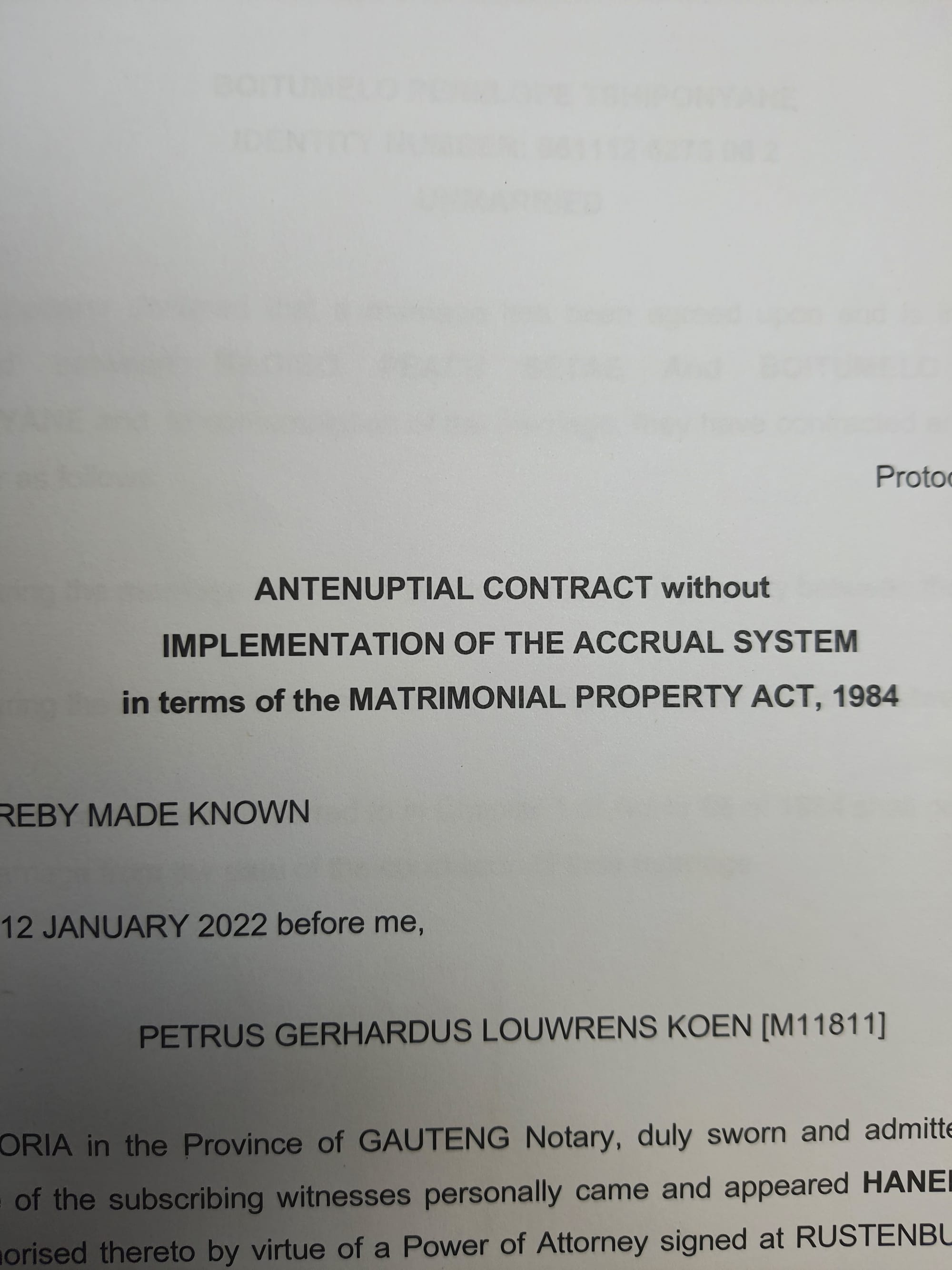

Although many couples check out marriage as a union of love and partnership, understanding antenuptial contracts can give necessary monetary clarity prior to celebrating a marriage. An antenuptial contract, also referred to as a prenuptial contract, is a lawfully binding document that outlines each companion's rights and obligations concerning residential property and finances in the occasion of divorce or fatality. It allows pairs to specify how assets will certainly be separated, shielding individual and family members inheritances. Furthermore, such contracts can resolve problems like financial obligation obligation and spousal assistance. By reviewing these issues in advance, pairs can promote openness, alleviate prospective conflicts, and produce a structure for a well balanced economic collaboration. Inevitably, antenuptial agreements function as a proactive action towards monetary safety in marital relationship.

Benefits of Having an Antenuptial Arrangement

Antenuptial arrangements use numerous essential benefits that can enhance monetary protection for pairs. They offer methods for asset protection, make clear debt obligations, and enable for personalized financial setups customized to specific needs. By addressing these facets, such contracts can considerably add to a much more transparent and secure monetary future.

Asset Protection Techniques

Several couples forget the substantial benefits of having an antenuptial contract, specifically when it pertains to property protection strategies. An antenuptial contract allows individuals to plainly define their different assets, making sure that personal effects remains protected in the occasion of divorce. This legal structure can safeguard inheritances, family businesses, and financial investments, protecting against disagreements over possession. Furthermore, it can supply clearness on the department of possessions gotten during the marriage, enabling couples to prepare for their monetary futures with self-confidence. By establishing these defenses in breakthrough, pairs can reduce possible conflicts and maintain their wide range. Eventually, a well-structured antenuptial contract functions as a proactive measure for monetary safety and security and tranquility of mind.

Financial Obligation Liability Clarification

When couples participate in marriage, the capacity for financial debt responsibility can become a considerable issue, specifically if one partner has pre-existing monetary commitments. An antenuptial contract serves as a crucial tool for clarifying each companion's financial obligation duties, thus securing both people from unpredicted monetary concerns. By clearly defining which financial obligations belong to which companion, the contract can protect against one spouse from being held accountable for the other's financial errors or commitments. This quality not only cultivates transparency however also aids in preserving the marriage connection by reducing prospective problems over financial resources. Ultimately, developing this framework allows couples to get in marital relationship with a common understanding of their economic landscape, lowering anxiousness relevant to debt management and obligation.

Customizable Financial Arrangements

Adjustable monetary setups in an antenuptial arrangement offer pairs the possibility to tailor their financial future according to their distinct needs and conditions. These contracts permit partners to define just how assets, earnings, and responsibilities will be managed during the marital relationship and in case of a splitting up. Pairs can define individual home rights and duties, therefore shielding personal properties and setting clear assumptions. In enhancement, they can integrate arrangements for spousal support, inheritance rights, and the division of property obtained during the marriage. By dealing with these elements proactively, pairs can lessen possible disputes and foster openness in their financial connection. Eventually, customizable monetary setups promote a complacency and understanding, laying a strong structure for a successful marriage.

Key Parts of an Antenuptial Contract

An antenuptial contract, usually described as a prenuptial contract, works as a vital device for pairs seeking to define their economic legal rights and responsibilities before marital relationship. Secret elements of such an agreement normally include the recognition of different and marital property, describing just how financial obligations and properties will certainly be managed throughout the marriage. Furthermore, it deals with the department of home in case of divorce or separation, specifying how assets will certainly be designated. The contract might additionally cover spousal support terms, making certain both events understand financial assumptions. Additionally, a clear dispute resolution process can be established, supplying advice on how to take care of potential disputes. These elements interact to promote openness and secure individual rate of interests within the marriage.

Common Misconceptions Concerning Prenuptial Agreements

What misconceptions might couples hold about prenuptial arrangements? Lots of people perceive these agreements as an indication of suspect or a lack of dedication. This misconception can prevent pairs from going over monetary planning freely. Others believe prenuptial arrangements are only for the affluent, when actually, they can be helpful for any individual wanting to protect their possessions. Some might believe that prenuptial contracts are stringent and can not be modified, but they can navigate to this site be revisited and altered as conditions advance. Additionally, there is an usual idea that prenups are just enforceable in separation, while they can also deal with economic matters during marital relationship. Overall, these false impressions can impede pairs from making notified decisions regarding their financial futures.

How to Approach the Conversation With Your Partner

Approaching the conversation concerning an antenuptial contract calls for careful consideration of timing and context. It is important to highlight the benefits of financial safety while straightening the discussion with specific goals. Selecting the best minute can promote a much more open and efficient discussion.

Pick the Right Minute

Picking the right minute to review an antenuptial agreement can greatly affect the end result of the conversation. Timing plays a crucial function in ensuring that both partners feel receptive and comfortable. It is advisable to start the conversation when both individuals are relaxed and without diversions, such as throughout a quiet dinner or a published here leisurely weekend break. Avoid bringing up the subject during mentally billed moments or stressful circumstances, as this can result in misunderstandings or defensiveness. Furthermore, revealing authentic intent and emotions about the future can help set a favorable tone. Ultimately, locating an ideal minute enables a more constructive and open discussion, paving the way for shared understanding and regard pertaining to economic matters.

Stress Financial Security

Economic security works as a foundational pillar in any kind of partnership, especially when reviewing antenuptial contracts. Couples should come close to the discussion with an open way of thinking, acknowledging that financial conversations can promote count on and transparency. Launching the dialogue can be performed in a calm setup, where both partners feel comfortable expressing their ideas. It is important to focus on the benefits of an antenuptial agreement, highlighting that it is an aggressive action in the direction of securing both companions' financial futures. By highlighting common worths and mutual goals, the discussion can shift from worry to collaboration. Urging a joint viewpoint on financial safety and security aids to reinforce the relationship, ensuring both individuals understand the significance of intending in advance for prospective unpredictabilities.

Go Over Individual Goals

Efficient communication concerning economic planning can result in a deeper understanding of private objectives within a partnership. Couples must approach this conversation with visibility and honesty, enabling each companion to express their concerns and aspirations. Establishing apart a specialized time to talk about next page financial goals fosters a risk-free atmosphere for discussion - antenuptial contract. Each companion ought to share their views on budgeting, saving, and spending, which can reveal differing values or concerns. Active listening is important, as it encourages empathy and compromise. Pairs can take advantage of talking about long-term objectives, such as home ownership, retirement, or traveling plans. By aligning individual objectives, companions can develop a shared vision that strengthens their financial structure and boosts their partnership. This good understanding is important for successful economic preparation

Lawful Considerations and Needs

Moving On: Creating a Tailored Antenuptial Arrangement

Creating a customized antenuptial arrangement needs mindful consideration of each partner's distinct financial situation and future objectives. Couples need to begin by freely reviewing their assets, debts, and revenue resources, assuring openness. Identifying individual economic priorities, such as financial savings, investments, and retirement plans, can assist shape the agreement's framework. Involving a professional lawyer knowledgeable in household legislation is necessary to browse regional guidelines and guarantee enforceability. Furthermore, both partners ought to remain flexible, as life situations may transform gradually, necessitating modifications to the agreement. By collaboratively crafting a detailed antenuptial agreement, couples can protect their rate of interests and foster a strong structure for their marriage, aligning monetary expectations and duties for the future.

Frequently Asked Questions

Can an Antenuptial Agreement Protect Future Inheritances?

An antenuptial agreement can without a doubt safeguard future inheritances by clearly outlining the distribution of assets. This legal record guarantees that specified inheritances stay different building, guarding them from any kind of claims during prospective divorce procedures.

Are Antenuptial Contracts Enforceable in All States?

Exactly how Frequently Should an Antenuptial Agreement Be Examined?

An antenuptial agreement needs to be assessed on a regular basis, preferably every couple of years or after substantial life changes, such as the birth of a child or modifications in economic conditions, to guarantee it continues to be reliable and pertinent.

What Occurs if We Don't Sign an Antenuptial Agreement?

If an antenuptial agreement is not authorized, the pair's marriage home will generally be controlled by the default regulations of their jurisdiction, often resulting in shared possession of possessions acquired during the marriage.

Can We Customize Our Antenuptial Contract After Marital Relationship?

Yes, antenuptial contracts can be modified after marriage. Both celebrations should agree to the adjustments, and it's a good idea to record the modifications officially to guarantee legal credibility and clearness in future financial matters.

Numerous pairs see marital relationship as a union of love and partnership, recognizing antenuptial contracts can provide crucial monetary clarity prior to connecting the knot. Adjustable monetary arrangements in an antenuptial agreement deal pairs the possibility to customize their financial future according to their distinct needs and scenarios. An antenuptial agreement, frequently referred to as a prenuptial agreement, offers as an important device for pairs looking to define their economic legal rights and obligations before marital relationship. It is essential to concentrate on the advantages of an antenuptial contract, stressing that it is a positive step towards securing both companions' monetary futures. antenuptial contract. While numerous couples recognize the value of an antenuptial contract in guarding their monetary rate of interests, comprehending the legal considerations and demands is essential for guaranteeing its legitimacy